I started trading stocks in February 2021. I went into it thinking, "How hard could it be?" I lost 20% on my first trade. I quickly realized that if I wanted to actually make money in the stock market, I needed to do some research. For my first year in the stock market, I didn't make much money. I spent the majority of that time learning about the market, not trading it. 2 years and hundreds of hours of research later, I finally feel like I understand the market.

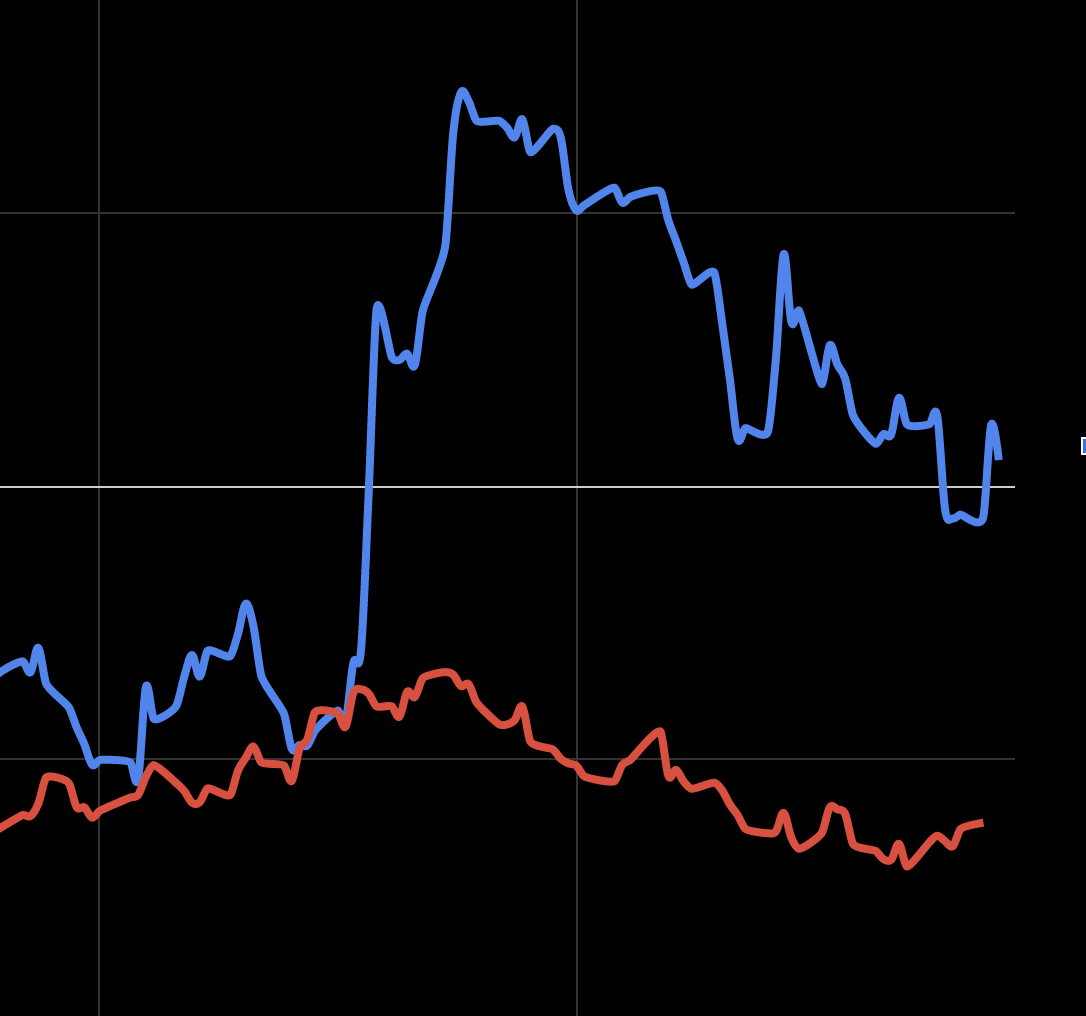

My 2022 portfolio:

January to March

At the beginning of the year, my portfolio (blue) underperformed the Nasdaq (red). I made a series of bad trades that ultimately led my to being down 37.19%. I was underperforming the Nasdaq by 17% at this time. From then until August my portfolio recovered a bit, by August 1st I was only down about 20%.

Summer-FallFor the first two months of summer, my portfolio chopped at the -20% level. It was at this point when I decided to change up my trading strategy. Before this I was trading random stocks that I thought would go up. Some of them did, but many of them didn't. Instead, I focused on buying stocks that were very undervalued, and were in for a bounce. Enter Bed Bath and Beyond. I saw that BBBY had lost over 70% of its value in a year. The market obviously thought BBBY was going to go bankrupt, but I didn't. I bought it at $6, and two weeks later I sold it at $24. This made my portfolio skyrocket to being up 25% YTD. I was outperforming the Nasdaq by 50%. But, over the course of a few months, my gains were slowly lost. First, my investment of Blue Apron lost 30% of its value in a couple weeks. Then my natural gas holdings decreased by 40% in less than two weeks. I am still outperforming the market, but I have taken a step back from activly trading to reorganize and remake my strategy.

|