Capstone: The Federal Reserve and inflation

Thesis: The Federal Reserve and other Central Banks around the world created the 2020-2021 stock market rally and 2022 inflation crisis by irresponsibly using a tool that injects liquidity into the economy known as Quantitative Easing.

My Capstone project is focused around the Federal Reserve's mismanagement of the economy, allowing for inflation to rise and the stock market to overheat. I have done a deep dive into why this happened, how the Federal Reserve could have prevented it, and how the rest of the world is affected by it.

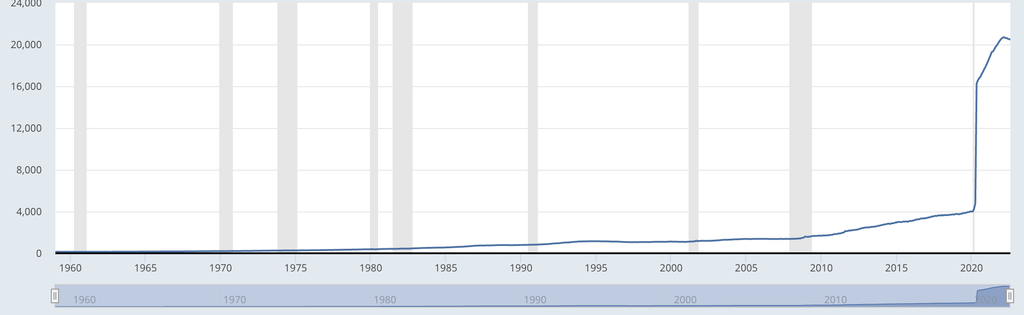

Quantitative Easing

United States M1 money supply

United States M1 money supply

Since the 2008 recession, the federal reserve has been continuously "printing" money by using the tool Quantitative Easing (QE), which is used to buy debt securities. During the 2020 Covid Crash, the FED was forced to print trillions upon trillions of dollars to prevent a total collapse of the economy. We are now feeling the effects of this money printing, with core Consumer Price Index(CCPI) hitting a 40 year high of 6.66%, and CPI hitting a 40 year high of 9.2%. However, QE is not the sole cause of inflation, supply shocks from the COVID-19 lockdowns around the world was a major cause of price increases. Even with this information, my paper is focused on how QE is a major reason why inflation exploded upwards.

"The Federal Reserve quickly reacted to the stock market's reaction, lowering rates by 1.5 percentage points in order to allow businesses to borrow, resulting in interest rates going to near zero."

Context: In response to the economic turmoil caused by the COVID-19 pandemic, the Federal Reserve lowered interest rates to stimulate borrowing and support businesses during the crisis.

"The Federal Reserve quickly reacted to the stock market's reaction, lowering rates by 1.5 percentage points in order to allow businesses to borrow, resulting in interest rates going to near zero."

Context: In response to the economic turmoil caused by the COVID-19 pandemic, the Federal Reserve lowered interest rates to stimulate borrowing and support businesses during the crisis.

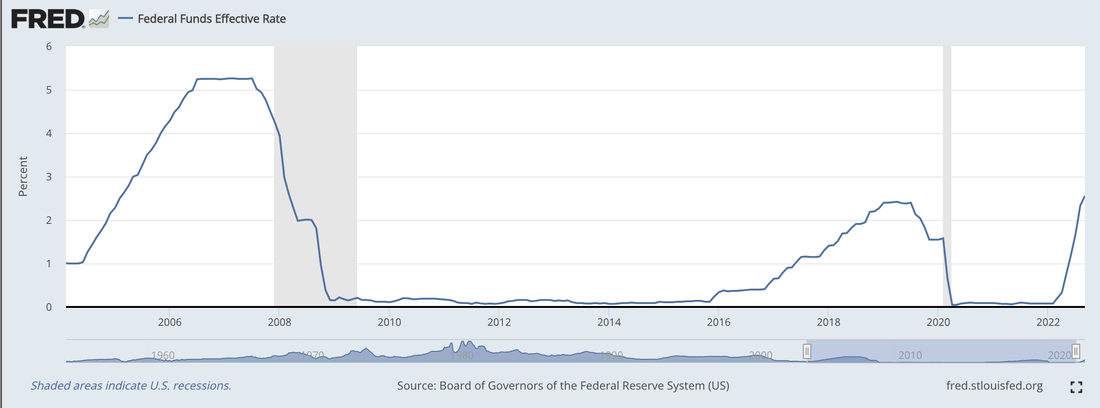

Interest rates

Federal Funds Effective Rates since 2004

Federal Funds Effective Rates since 2004

Since 2009, the federal reserves interest rates have been at 0 or near 0 for the past decade. Interest rates are how much it costs to borrow money, having 0 rates means that it barely costs a business anything to borrow, leading to growth. In 2018 the FED attempted to raise rates, but the Covid-19 pandemic, along with Former President Donald Trump pressuring the chairman of the FED Jerome Powell, put a stop to this. This 0 interest rate environment led to historic economic growth. The federal reserve has been hiking rates faster than almost any time in history. The Fed has realized their mistake and is desperately trying to fix it. While rate hikes have had an impact on inflation, they are also causing a contraction in the economy. Economists are predicting a recession in 2023 due to these rate hikes.

"Raising rates has seemingly worked, as CPI is at 7.1% year-on-year in 2022 with inflation only growing 0.1% in November 2022."

Context: In response to the inflation crisis, the Federal Reserve raised interest rates, which appeared to have a positive effect on controlling inflation, but at the expense of American consumers.

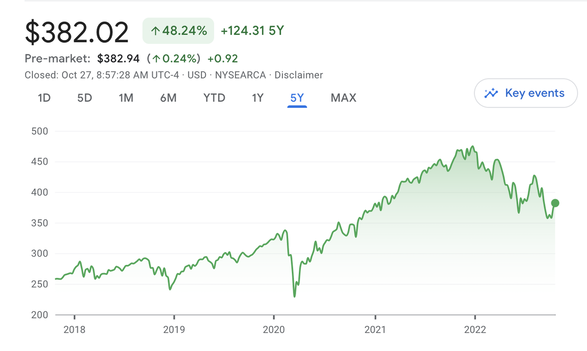

The 2020-2021 stock market rally

Due to added liquidity because of QE, the S&P 500 stock index, an index which is composed of the top 500 U.S based companies, grew over 100% its lowest point during the COVID-19 crash, one of the fastest market recoveries in history. This market rally was only possible because of the Federal Reserve's buying of assets.

Myths about inflation

Many politicians have called this rise of inflation "the Putin price hike." Although the Ukrainian war has had an affect on gas and food prices, it is not the sole reason why inflation exploded upwards.

My Paper

- Introduction: Impact of COVID-19 pandemic on global economy, use of Quantitative Easing (QE) to inject liquidity, consequences on stock market rally and inflation crisis

- Federal Reserve: Overview of its structure, function, and role in monetary policy

- 2008 Financial Crisis: Causes, impacts, and government responses, including the use of QE

- COVID-19: Economic effects and government responses, including lowering interest rates and implementing QE

- 2021 Stock Market Rally: Factors contributing to the rally, including QE and improved economic conditions

- 2022 Inflation Crisis: Causes, including QE, supply chain disruptions, and Russo-Ukrainian war, impact on the cost of living and consumer savings.

- Federal Reserve's Response: Increasing interest rates, implementing Quantitative Tightening, and consequences for consumers

- United Kingdom's QE: Stabilizing the market and promoting economic recovery

- Inflation Myths: Russo-Ukrainian war, corporate greed, and their limited impact on inflation

- Conclusion: Challenges and consequences of QE during the COVID-19 pandemic, inflation control at the expense of American consumers, and the necessity of QE during the crisis

You can read my paper here:

https://docs.google.com/document/d/1EPULwtUZ3iBOUyJqOKwxPCglgQu_mJZLMvLbetpO7lI

You can also view my Annotated Bibliography here: https://docs.google.com/document/d/1YXAeojUstYu8yXxHETySeocFl3PIwZxdQJt4uUxQTuI

Product 2

For my second product have created a social media campaign on TikTok explaining the federal reserve and the inflation crisis of 2022. I have been making media since I was 10 years old, and I decided to take on the challenge of making short form content. It was tough getting the script down to under 60 seconds, but eventually I did. It was a really fun process creating and filming the video's, however when I was creating the tik tok account, I kept getting multiple errors (Which is how I accidentally got this username!)

You can find them here: https://www.tiktok.com/@owenwontwork

For my second product have created a social media campaign on TikTok explaining the federal reserve and the inflation crisis of 2022. I have been making media since I was 10 years old, and I decided to take on the challenge of making short form content. It was tough getting the script down to under 60 seconds, but eventually I did. It was a really fun process creating and filming the video's, however when I was creating the tik tok account, I kept getting multiple errors (Which is how I accidentally got this username!)

You can find them here: https://www.tiktok.com/@owenwontwork

Product 3

My third and final product was a survey. I wanted to make a survey in order to understand how much people in high school (and middle school) understand and discuss finance. I used a variety of sources when making this survey, I wanted this to be easy to complete yet informative. I think I succeeded with this task, you can view the survey here: https://forms.gle/bJBi8tLe6g2BCSYk8

You can find my analysis here: docs.google.com/document/d/1BR6ho3cp9-4xTgVefk8inBV6KJ64zWvd89cg0CHko90

You can find my analysis here: docs.google.com/document/d/1BR6ho3cp9-4xTgVefk8inBV6KJ64zWvd89cg0CHko90